Natural Capital is increasingly spoken about when forest and/or ranch lands are being transacted, whether for outright sale/purchase or for long-term leases. In Scotland (UK), for example, we have seen a several-fold increase in the value of pasture commensurate with the value that the restoration of the pasture to woodland represents in terms of carbon value.

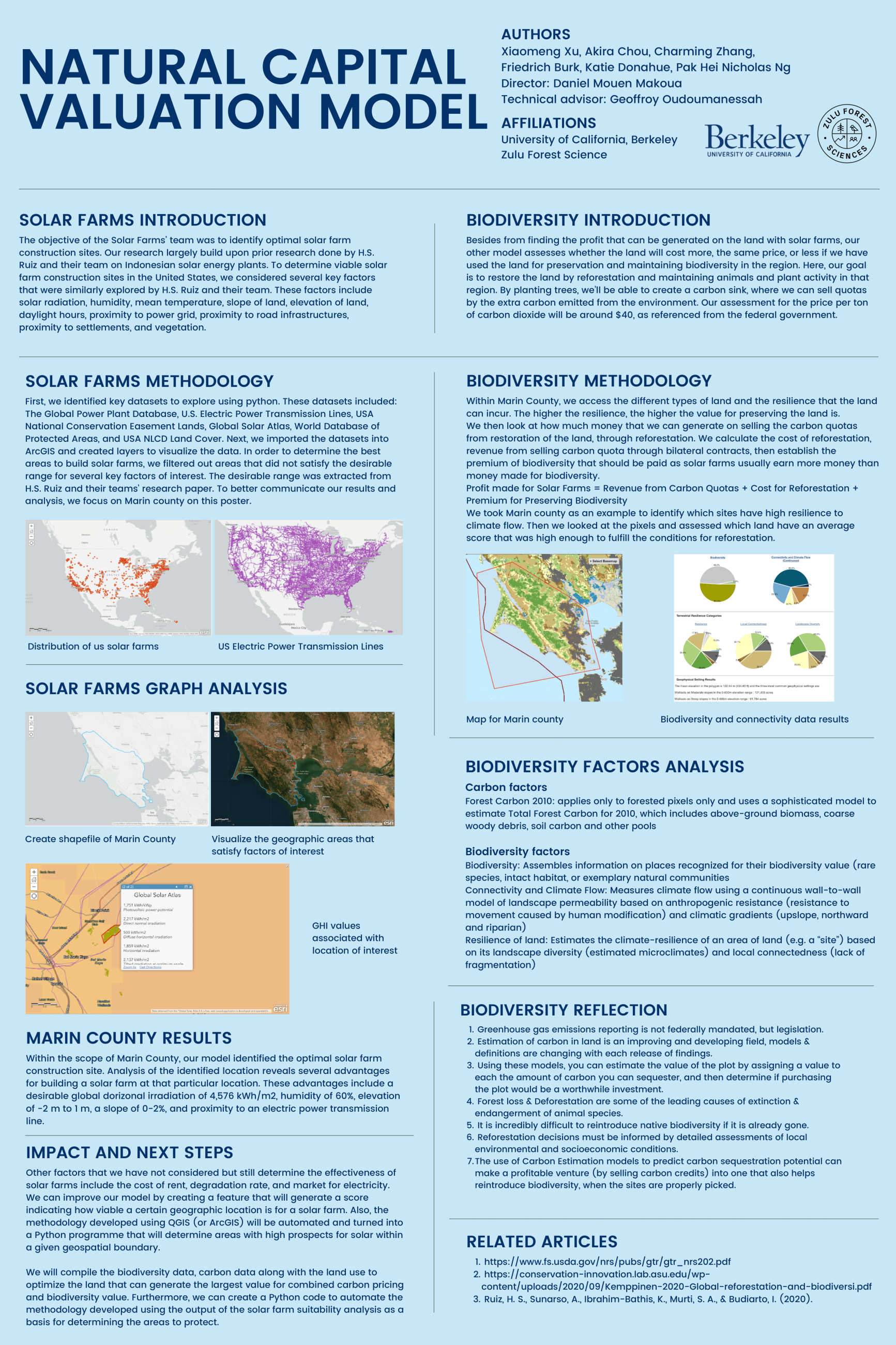

At Zulu Forest Sciences, we apply quantitative and project finance principles and methods to determine a forest project’s economic prospects, including capital requirements, capital/operating expenditures, forward price curves, project cashflow and average duration.

The proposed project will focus on project economics across a wide range of current and historical transactions, providing a systematic way to determine the potential value of natural capital, which is a critical input in any project feasibility analysis.

Participants will apply cross sectional regression analysis to price data to determine the critical factors that explain asset prices, including conventional factors such as socioeconomic factors and land use, as well as carbon sequestration prospects and biodiversity/climate resilience scores.

The project will focus on target states/eco-regions, including Missouri, Virginia, Kentucky, Tennessee, South and North Carolina.